Hi all,

Here is your fourth week of Financial Literacy Friday, a fun and simple roundup of my best tips and tricks on personal finance and money management.

This week, I’ll be talking about budgeting. If you’re anything like me, you might be thinking there is no room in your budget to cut expenses. Or maybe you don’t have a budget at all.

I’ll admit, I’m not a die hard budgeter myself. But the day I decided to create a budget and could actually see where all of my money had been going, I found it to be a huge sense of relief. Not only was I able to save a few extra bucks, but I also was able to allocate more to the areas that mattered most to me.

Now, let's dig a little deeper...

____________________________________________________________________________

Topic of the Week - Budgeting

I’ll never forget the story about one of the most successful financial advisors in California. Whenever a new client would begin working with her, the first thing she’d do was ask to see their wallet. Every time, the client would hesitantly pull his/her wallet out with a look of confusion on their face. The adviser would snatch the wallet and pull out every credit card one by one. After all the cards were out, she’d grab a pair of scissors and cut them all in half. “Now let’s see you put your money where your mouth is” she’d say to them.

It’s crazy to think how much we’ve all normalized spending. With the ease of a swipe, we can buy just about anything we want instantaneously. It feels like “free money” in the moment, but as soon as that monthly bill comes around we often regret the purchases we made.

Most of us have plenty of slack in our budgets, we just don’t feel like tightening the belt. Myself included. There are so many aspects to a budget, and what works for you may not work for everyone else. But for today, I’ll be discussing the Four Simple Rules For Successful Budgeting that I learned from the online budgeting tool YNAB. Four simple rules that I believe can (and should be) applied by just about everyone.

Rule One: Give Every Dollar a Job.

As soon as you have any sort of income, you decide what that money needs to do. Instead of buying something based on your mood or the fact that your checking account looks healthy this month, you decide based on a pre-constructed plan. Ultimately, every dollar should have a job resulting in zero dollars left over for wasted spending.

Put simply:

Earn income

Prioritize every dollar by assigning them to each area of your budget (this can include savings and investment accounts)

Follow your plan

Rule Two: Embrace Your True Expenses.

Imagine never dreading the arrival of a big bill such as an insurance premium or an auto repair. Take those large, infrequent expenses and break them up into monthly manageable amounts. By looking ahead, you’re now making fully informed spending decisions based on both immediate needs AND future obligations.

Put simply:

Find a big, infrequent expense

Create a goal to fund it monthly

When that expense arrives, pay it

Rule Three: Roll With The Punches.

It’s important to be flexible with your budget and address overspending as it happens. If you overspend in one category, free up money from another and move it to the overspent category. Did you have some friends unexpectedly come visit and decide to splurge on dinner and drinks with them? No need to panic. Just move some money from one of your other non-essential budget categories and cut back on that one category for the month.

Put simply:

Choose a category where you overspent

Move funds from another category to cover it

Move on with your life

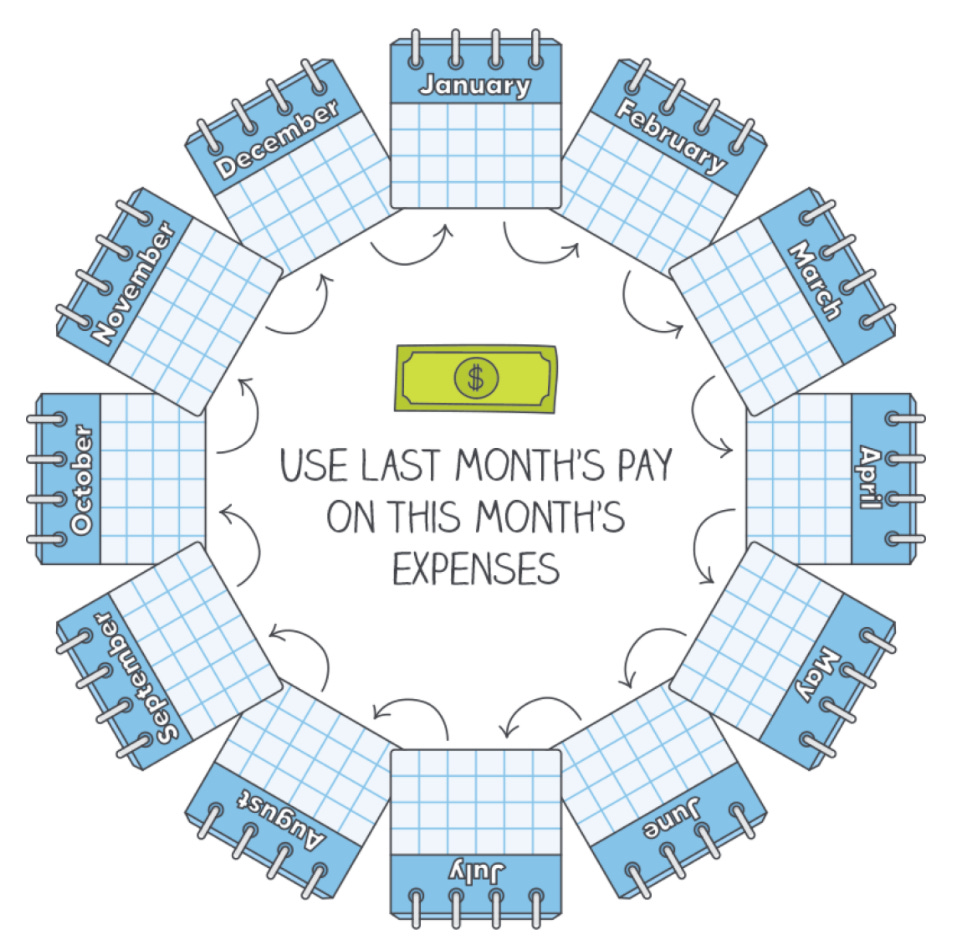

Rule 4: Age Your Money

The goal here is to be spending money that is at least 30 days old. In utilizing the previous three rules to be more purposeful with your spending, eventually you’ll be able to cover October’s rent with dollars from September. Instead of waiting for the next paycheck to pay your bills, you’ll be able to pay them as soon as they arrive by putting them on autopay months ago.

Put simply:

Be purposeful with your spending

Always spend less than you earn

Let that age of money grow

Without a budget, you’ll never know for certain what your money is doing or where it is going. No matter how big or small your bank account may be, it lacks purpose. For many, this creates uncertainty which often leads to unnecessary worry. Can you pay the bills next month? Will you be spiraling into even more debt and forced to pay interest on your credit card purchases? Can you afford that family vacation you’ve been dreaming of going on? Budgeting does not need to be restrictive. Instead of spending less, think of it as spending right.

____________________________________________________________________________

Timely Article - “My Pay Was Reduced by 75% but I'm Going to Be OK.”

A timely article given the amount of people who have either lost their jobs or had reduced pay due to the pandemic. By figuring out what the essentials were and defunding the rest, a father of two who was about to close on a house and lost 75% of his normal play was able to make it work.

____________________________________________________________________________

Statistic That Surprised Me

Source: https://www.youneedabudget.com/

____________________________________________________________________________

Quotes I Like

”If we command our wealth, we shall be rich and free. If our wealth commands us, we are poor indeed.”

– Edmund Burke

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people that they don’t like.”

– Will Rogers

“Don't tell me what you value, show me your budget, and I'll tell you what you value.”

– Joe Biden

____________________________________________________________________________

Useful Visual

____________________________________________________________________________

Question To Think About

What is something that isn’t necessarily something you need to spend money on, but brings so much value to your life that you aren’t willing to give it up?

On the flip side, what is something you’ve been spending money on that doesn’t add any value to your life? Consider allocating some of that spending to the area you selected for the first question.

____________________________________________________________________________

Tip of the Week

There are a lot of free tools out there to help you budget. Personal Capital, Mint, and Clarity are three of the most popular free ones. However, if you really want to get deep in this area and are someone who needs all the help you can get to stay on track, I highly recommend checking out YNAB (You Need A Budget) and paying for their services (you can try it for free for 34 days and if you ask nicely, they’ll likely give you an extra 30 days). If you decide you like it, it’ll cost you $11.99/month or $84/year. Well worth it if it helps you save hundreds or thousands in the long run.

____________________________________________________________________________

Challenge of the Week

Write down all the things you currently spend money on. Utilize your credit card statements or whatever digital tool you use. Now divide these up into two categories: “Bare Essentials” (everything you need to meet your basic needs - housing, utilities, food, medication, transportation, insurance and debt payments) and “Everything Else” (anything you spend money on that isn’t a necessity - eating out, entertainment, new clothes, toys, etc.)

Now take the “everything else” category and rate the degree of joy or value you receive from each item on a scale of 1 (low) to 5 (high). Utilize this exercise to assess how aligned your spending is with the things that truly bring you happiness and add value to your life.

For me, health and fitness are a 5, so I don’t hesitate to spend money on those areas. Shopping, on the other hand, is more like a 1 or 2 for me so I’m happy to cut back.

If you’re in a relationship, try doing this exercise with your partner. You might be surprised what you learn about each other in the process.

And remember, don’t feel like you need to cut so low that you make yourself miserable. Instead, the purpose of this is to be mindful and start putting money towards the things that add the most value to your life.

____________________________________________________________________________

Personal Reflection

When a few of my friends first brought up the idea of going to the Galapagos Islands for a week to end our South America trip, I thought there was no way I could afford it. After some considerable convincing and the realization that this was a once in a lifetime opportunity, I decided I had to find a way to make it work.

Between using credit card points for my flights, staying in low cost hostels, packing our own lunch each day and researching adventures that we could do on our own instead of paying for a guide, the seven day trip of a lifetime became a reality.

Don’t let the “normal” cost of experiencing something amazing in life hold you back. Find ways to make it work for you. And while it may be nice to pay to have it all planned out for you, some of our best days were the ones spent exploring something not written about on Tripadvisor, but instead by the suggestion of a local. Whatever your budget may be, you can often find ways to make it work.

____________________________________________________________________________